Mastercard’s strengthened MMP requirements are reshaping onboarding and monitoring

Acting now ensures smoother compliance, reduced operational burden, and better outcomes for your merchant portfolio.

G2 Risk Solutions automates and operationalizes these requirements end-to-end, giving you a clear path to 2026 compliance.

Scalable, confident compliance

Meet Mastercard’s expanded expectations with fewer surprises, clear evidence trails, and the ability to scale monitoring without adding headcount.

Proactive, actionable intelligence

Identify BRAM, TL, MCC, and marketplace issues early. Reduce fines, prevent escalations, and improve decisioning.

Smarter, faster resolution

Reduce manual review, accelerate investigations, and confidently meet the 15-day remediation requirement.

Complete, unified transparency

Gain visibility into URLs, products, sellers, and gated content to uncover issues other tools miss. Deliver complete documentation in line with MMP standards.

Rules for all merchants boarded on or after January 1, 2026

- Mandatory initial scan before first transaction

- Complete merchant data required (legal names, DBAs, URLs, MMSP data)

- Monitoring must include gated and member-exclusive content

- Documentation must show initial scan and evidence of persistent monitoring

- Findings must be investigated and resolved within mandated timelines of 15 days

Future-proof your compliance with G2RS

With Mastercard’s new requirements, payment providers must raise their standards for merchant onboarding. G2RS Global Onboarding delivers the automation, data depth, and advanced monitoring you need to stay ahead. If you’d like to learn how G2RS can help your organization prepare for Mastercard’s 2026 requirements, get in touch with our team today.

Get in TouchThe complete solution for Mastercard’s 2026 MMP requirements

MMP compliance at onboarding

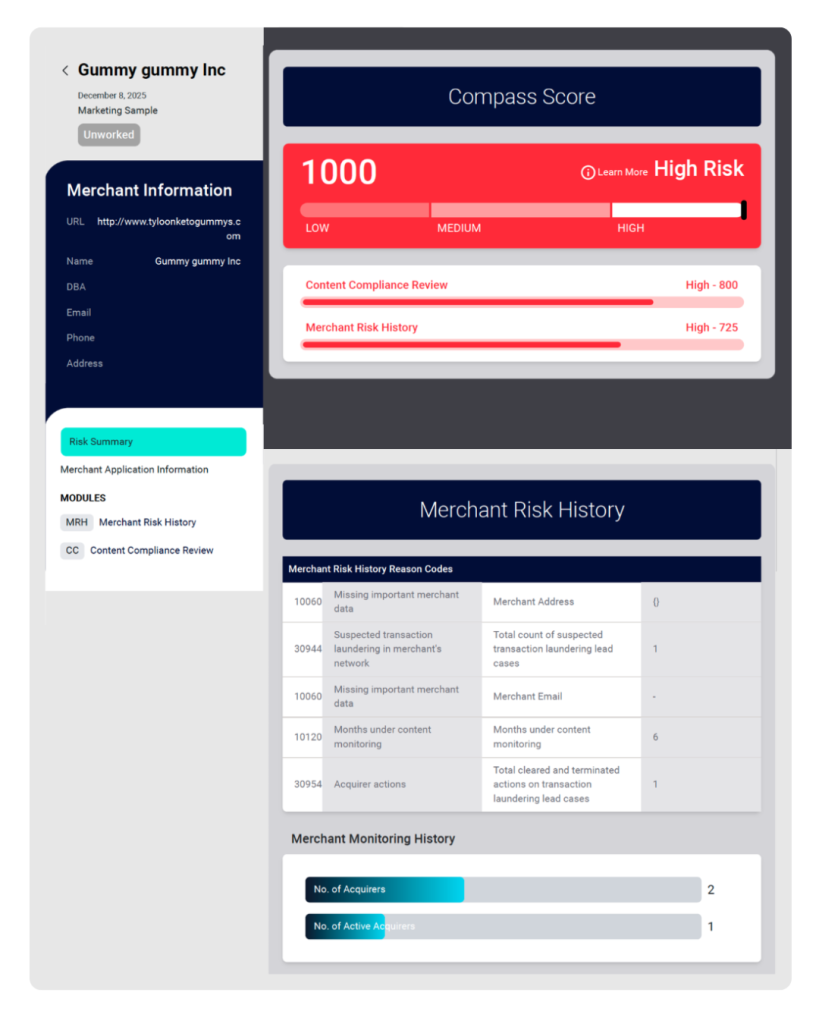

Approve good merchants faster and stop risky ones earlier. Reducing fines, avoiding escalations, and strengthening audit readiness. Global Onboarding’s automated Merchant Risk History (MRH) component integrates past merchant behavior patterns and up-to-date information, to predict future risk.

Historical data

- Confirmed/suspected transaction laundering cases

- Confirmed/potential content violations

- MCC change history: Can point to past high-risk activity

Risk signals

- Types of data that indicate potential merchant risk: Duplicates with other merchants, connections to illicit activity, incorrectly submitted data, age of domain

Get your content in order

Continuous monitoring and automated content checks provide complete visibility to maintain and document compliance. Global Onboarding’s Content Compliance (CC) scans merchant websites for BRAM-restricted content, quickly identifying violations and risk before the first transaction, without slowing the onboarding process.

Audit-ready reports

- Violations classified according to severity and categories

- Audit notes provide a deeper look at decision reasoning

- Screenshots furnish evidence for compliance documentation

Persistent monitoring at scale

- Automatically scan the site, including gated/password-protected content

- Transition from onboarding to monitoring with just one click

- Access consistent, comprehensive merchant data in a unified portal

Merchant Risk Solutions

Simplifying Compliance with Mastercard’s New MMP Rules

Mastercard’s new Merchant Monitoring Program (MMP) requirements will take effect on January 1, 2026. These updates are designed to ensure stronger up-front compliance, reduce transaction laundering, and help protect the payments ecosystem.

Learn More

Global Onboarding

Acquire merchants at scale and make faster, smarter onboarding decisions based on vast data sets, synthesized into a configurable user interface and API. Identify and predict risky merchant behavior using AI-powered aggregate scoring and deep-dive capabilities into the underlying details.

Learn more

Persistent Merchant Monitoring

Monitor your merchant portfolio for sudden or unexpected content violations. Increase your portfolio’s profitability by confidently monitoring a variety of merchant business types.

Learn more

Transaction Laundering Detection

Reveal hidden connections to transaction laundering networks and ensure portfolio compliance. Get the detailed evidence you need to help support your case for terminating a violating merchant.

Learn more